Last Updated on 27 March 2024

One year ago, a client sought guidance regarding her financial struggles. For privacy reasons, let’s call her “Sarah.” Sarah, a single mother of two girls, juggled two jobs to make ends meet. Despite her hard work, she struggled to keep up with expenses. Worries about paying bills and providing for her children weighed heavily on her mind. Feeling overwhelmed by her financial challenges, Sarah decided to seek help. She scheduled an appointment to meet with me, her financial adviser. During our meeting, Sarah opened up about her situation, expressing her concerns about supporting her family while on a low income as a single parent.

After carefully listening to Sarah’s story, I offered her guidance and support. We discussed creating a budget to track her expenses and prioritize essential needs like rent, utilities, and groceries. Together, we developed a plan to cut back on non-essential spending while ensuring Sarah could cover her necessities. I also encouraged Sarah to explore opportunities to increase her income, whether through part-time work or freelance gigs. We discussed the importance of building an emergency fund to handle unexpected expenses and save for the future.

In the months that followed, Sarah remained dedicated to following our plan. She diligently tracked her expenses, looked for ways to save money, and even started a small business selling handmade crafts online. With each passing month, Sarah’s financial situation began to improve. She could pay her bills on time, save for emergencies, and occasionally treat her children to special holidays.

Sarah’s story resonates with many women facing similar challenges. In this article, I will share expert tips on how to budget with a low income. We will cover various aspects of budgeting, including understanding your income and expenses, setting realistic financial goals, crafting a budget that fits your low income, reducing expenses, increasing your income streams, and managing debt wisely. With these tips, you can gain control of your finances and work towards a more secure and financially stable future.

Budgeting is a crucial skill for moms, regardless of their income level. However, it can be particularly challenging to budget with a low income. Many budgeting strategies and financial advice cater to individuals with higher salaries and more disposable income. But the truth is that budgeting is even more critical for those who have limited financial resources. By budgeting effectively, you can gain a clear understanding of where your money is going, make adjustments to your spending habits, and work towards your financial goals.

Understanding Your Income and Expenses

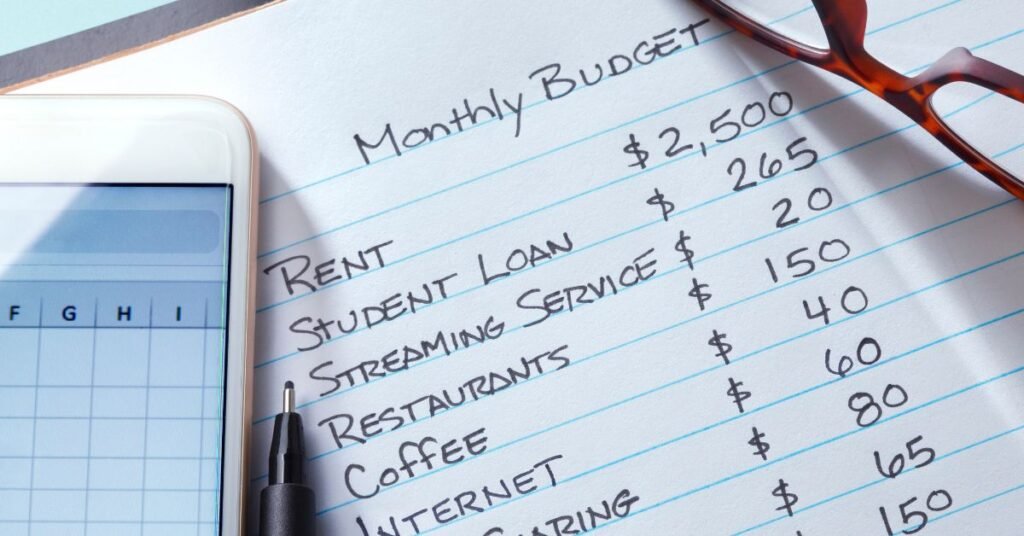

Before you can create a budget, it is essential to have a clear understanding of your financial situation. Start by evaluating your income. This includes not only your salary but also any additional sources of income, such as side hustles or freelance work. Next, consider your monthly expenses. Take a close look at your bank account statements to identify your regular monthly expenses, such as rent or mortgage payments, utility bills, transportation costs, groceries, and any other recurring expenses. This will give you a clear picture of your income and expenses, helping you identify areas where you can potentially cut back and save.

Identifying Essential and Non-Essential Expenses

Once you have a clear understanding of your income and expenses, the next step is to identify essential and non-essential expenses. Essential expenses are those that are necessary for your basic needs, such as housing, utilities, food, and transportation. Non-essential expenses, on the other hand, are things that you can cut back on or eliminate if you are on a tight budget. These may include dining out, entertainment, subscriptions, and discretionary spending. By differentiating between essential and non-essential expenses, you can prioritize your spending and make adjustments to fit your low-income budget. It’s important to note that while non-essential expenses may be enjoyable, cutting back on them can free up more money for essential expenses and savings.

Tips for Tracking Your Monthly Cash Flow

Tracking your monthly cash flow is essential for effective budgeting. It allows you to monitor your income and expenses and make informed financial decisions. Here are some tips for tracking your monthly cash flow:

- Record your income and expenses using a budgeting app or spreadsheet. This will help you visualize where your money is going and identify areas where you can make adjustments.

- Review your credit card statements regularly to track your spending. Look for unnecessary or excessive charges, and consider cutting back on those expenses.

- Monitor your bank account regularly to ensure that your income is being deposited correctly and to keep track of your expenses. This will help you avoid overdraft fees and identify any fraudulent activity.

- Set up automatic transfers to a savings account. This can help you build an emergency fund and save for future goals. Review your savings account balance regularly to track your progress.

By tracking your monthly cash flow, you can better understand your financial habits and make the necessary adjustments to stay on track with your budget.

Setting Realistic Financial Goals

Setting financial goals is an essential aspect of budgeting. It gives you something to work towards and helps you stay motivated. When setting financial goals, it is necessary to be realistic and consider both short-term and long-term objectives. Short-term goals may include paying off credit card debt, saving for a vacation, or building an emergency fund. Long-term goals may include saving for retirement, buying a house, or starting a business. By setting realistic financial goals, you can create a budget that aligns with your aspirations and helps you achieve financial success.

Short-term vs Long-term Financial Planning

Short-term and long-term financial planning go hand in hand with budgeting. Short-term planning focuses on immediate goals and expenses, while long-term planning encompasses future financial needs and aspirations. Short-term financial planning includes creating an emergency fund to cover unexpected costs, setting savings goals for specific purchases or events, and managing day-to-day expenses within your income. Long-term financial planning involves saving for retirement, investing in education, and planning major life events such as buying a house or starting a family. By considering both short-term and long-term financial planning, you can create a budget that addresses your immediate needs while setting you up for future financial stability.

Importance of Setting Achievable Targets

Setting achievable targets is crucial for successful budgeting. It’s essential to set realistic goals that are attainable within your financial situation. Setting goals that are too ambitious can lead to frustration and discouragement, while setting goals that are too easy may not provide enough motivation. You can track your progress and celebrate small wins by setting achievable targets. It is also important to set financial milestones that can serve as checkpoints and guide your budgeting decisions. For example, saving a certain amount for a down payment on a house or paying off a personal loan by a specific date. By setting achievable targets, you can stay focused and motivated on your budgeting journey.

How To Budget With A Low Income

A budget that fits your low income is essential for effective financial management. It involves prioritizing your expenses and making strategic choices with your limited resources. When creating a budget, list your essential expenses, such as housing, utilities, food, and transportation. These are the expenses that are necessary for your basic needs. Next, allocate a portion of your income towards savings and debt payments. Finally, consider your discretionary spending and adjust it to fit your low-income budget. By crafting a budget that aligns with your low income, you can ensure that you are living within your means and working towards your financial goals.

The Basics of Creating a Flexible Budget

Creating a flexible budget is crucial for managing a low income. A flexible budget allows you to adapt to unexpected expenses or changes in your financial situation. Here are the basics of creating a flexible budget:

- Start by categorizing your expenses into fixed and variable costs. Fixed expenses remain the same each month, such as rent or mortgage payments. Variable expenses are more flexible and can vary from month to month, such as groceries or entertainment.

- Allocate a portion of your income towards fixed expenses, variable essential expenditures, savings, and debt payments.

- Leave some room in your budget for unexpected expenses or emergencies. You can achieve this by setting aside a portion of your income as an emergency fund.

- Review and adjust your budget regularly as needed. If you have extra money left over at the end of the month, consider allocating it to savings or paying off debt.

By creating a flexible budget, you can be prepared for unexpected expenses and have the flexibility to make adjustments when needed.

Adjusting Your Budget for Unexpected Expenses

Unexpected expenses can throw a wrench in even the most well-planned budget. That is why it is important to be prepared and have a plan for adjusting your budget when unexpected expenses arise. Here are some tips for adjusting your budget for unforeseen expenses:

- Start by building an emergency fund. You contribute to this separate savings account regularly to cover unexpected expenses. Aim to save at least three to six months of living expenses.

- When an unexpected expense occurs, evaluate your budget and identify areas where you can temporarily cut back to cover it. This may mean trimming discretionary spending or saving on essential expenses.

- Consider alternative funding sources, such as using savings, redirecting money from other budget categories, or exploring low-interest loan options.

- Once the unexpected expense has been addressed, reassess your budget and make the necessary adjustments to replenish your emergency fund and ensure you are staying on track with your financial goals.

By being prepared and proactive, you can navigate unexpected expenses without derailing your budget or compromising your financial stability.

Strategies to Reduce Expenses

Reducing expenses is a key aspect of budgeting with a lower income. By finding ways to cut costs, you can free up more money to allocate towards savings or debt payments. Here are some strategies to reduce expenses:

- Lower utility bills by being mindful of energy consumption, using energy-efficient appliances, and adjusting thermostat settings.

- Practice smart grocery shopping by creating a list, comparing prices, using coupons, and buying in bulk.

- Cut down on dining out and prepare meals at home. This can save a significant amount of money on food expenses.

- Look for ways to save on other regular expenses, such as transportation, entertainment, and subscriptions.

By implementing these strategies, you can make your money stretch further and achieve more financial stability despite a lower income.

Cutting Down on Utility Bills

Utility bills can be a significant expense for many households. However, there are several strategies you can use to cut down on your utility bills and save money. Here are some tips:

- Be mindful of your energy consumption. Turn off lights and appliances when not in use, unplug electronics, and use power strips to easily turn off multiple devices at once.

- Use energy-efficient light bulbs, that use less energy and last longer than traditional incandescent bulbs.

- Adjust your thermostat settings to save on heating and cooling costs. Consider using a programmable thermostat to automatically adjust the temperature when you are away from home.

- Insulate your home to prevent energy loss. Seal drafts around windows and doors, use weather-stripping and add insulation to your attic and walls.

- Consider investing in energy-efficient appliances, saving you money on utility bills in the long run.

By implementing these energy-saving strategies, you can reduce your utility bills and save money each month.

Smart Grocery Shopping on a Budget

Grocery shopping can be a significant expense, but with some smart strategies, you can save money and stick to your budget. Here are some tips for smart grocery shopping on a budget:

- Create a shopping list before you go to the store and stick to it. This will help you avoid impulse purchases and stay focused on what you really need.

- Compare prices and look for the best deals. Consider shopping at discount stores or using coupons to save even more.

- Buy generic or store brands instead of name brands. In many cases, the quality is comparable, but the price is lower.

- Plan your meals and use leftovers. This can help you avoid food waste and stretch your grocery budget further.

- Consider buying in bulk for items that you use frequently. This can save you money in the long run.

By implementing these strategies, you can save money on your grocery shopping and reduce your overall expenses.

Increasing Your Income Streams

Increasing your income streams can provide additional financial flexibility and help you reach your financial goals faster. Here are some strategies to increase your income:

- Explore side hustles or part-time jobs. Look for opportunities to monetize your skills or hobbies, such as freelance work or gig economy jobs.

- Leverage your skills for freelance opportunities. To earn extra money, consider offering services on platforms like Upwork or Fiverr.

- Look for additional sources of income, such as renting out a room on Airbnb or starting a small online business.

By diversifying your income streams, you can increase your earning potential and improve your financial situation.

Exploring Side Hustles and Part-time Jobs

A side hustle or part-time job can be a great way to supplement your income and increase your financial stability. Here are some side hustle ideas and part-time job opportunities to consider:

- Freelance work: If you have marketable skills, offer your services as a freelancer. This could include graphic design, writing, web development, or social media management.

- Delivery driver: Sign up with a food delivery service or a ridesharing platform to earn extra cash in your free time.

- Tutoring: If you excel in a particular subject, consider offering tutoring services to students needing extra help.

- Pet sitting or dog walking: If you love animals, consider offering pet sitting or dog walking services in your neighborhood.

- Retail or hospitality: Look for part-time job opportunities in the retail or hospitality industry, especially during peak seasons.

By exploring side hustles and part-time jobs, you can earn extra money to supplement your income and achieve your financial goals faster.

Leveraging Skills for Freelance Opportunities

Freelance work can be a lucrative way to earn extra money and use your skills and expertise. Whether you are a graphic designer, writer, programmer, or marketing specialist, there are opportunities to offer your services freelance. Platforms like Upwork, Fiverr, and Freelancer connect freelancers with clients seeking specific skills. By leveraging your skills for freelance opportunities, you can earn extra money and potentially turn your freelancing into a full-time career. It’s essential to market yourself effectively and deliver high-quality work to build a reputation and attract more clients. With dedication and perseverance, freelancing can become a valuable source of income and provide the financial flexibility you desire.

Effective Savings Techniques

Saving money is a crucial aspect of budgeting and building financial stability. Here are some effective savings techniques to consider:

- Open a savings account specifically for your savings goals. Set up automatic transfers from your checking account to your savings account to make saving a seamless process.

- Consider direct deposit as a way to automate your savings. Have a portion of your paycheck deposited directly into your savings account before you have a chance to spend it.

- Pay yourself first by allocating a portion of your income towards savings before paying your bills or other expenses. Treat your savings as an essential expense that must be paid each month.

By implementing these savings techniques, you can make saving money a priority and work towards your financial goals.

The Power of Paying Yourself First

Paying yourself first is a powerful strategy for building savings and achieving your financial goals. The concept is simple: allocate a portion of your income towards savings before paying for any other expenses. By treating your savings as a priority, you ensure that you are consistently setting money aside for your future. This can help you build an emergency fund, save for major purchases, or work towards long-term financial goals such as retirement. Setting up automatic transfers from your checking account to your savings account can make paying yourself first a seamless and effortless process. By making saving a top priority, you empower yourself to take control of your finances and create a secure financial future.

Utilizing High-Interest Savings Accounts

Utilizing high-interest savings accounts can be a smart strategy for maximizing the growth of your savings. High-interest savings accounts offer higher interest rates compared to traditional savings accounts, allowing your money to grow faster over time. When choosing a high-interest savings account, consider factors such as the interest rate, fees, and accessibility of your funds. Look for accounts that offer competitive interest rates and have no or low fees. By utilizing high-interest savings accounts, you can make the most of your savings and earn extra money on your deposits. This can help you achieve your financial goals faster and create a solid foundation for your financial future.

Managing Debt Wisely

Managing debt wisely is essential for maintaining financial stability and achieving your financial goals. Here are some strategies for managing debt:

- Prioritize and pay off high-interest debt first to minimize interest charges.

- Make regular debt payments on time to maintain a good credit score.

- Consider consolidating high-interest debt with a lower-interest personal loan.

- Avoid taking on new debt unless necessary and carefully consider the terms and interest rates.

By managing debt effectively, you can reduce financial stress, save money on interest payments, and work towards a debt-free future.

Strategies for Prioritizing and Paying Off Debt

Prioritizing and paying off debt is an important step towards financial freedom. Here are some strategies for prioritizing and paying off debt:

- Make a list of all your debts, including credit card balances, personal loans, and student loans. Take note of the interest rates and minimum payments.

- Consider the debt avalanche method, where you prioritize paying off debts with the highest interest rates first. This can save you money on interest payments in the long run.

- Alternatively, you can use the debt snowball method, where you prioritize paying off debts with the smallest balances first. This can help you build momentum as you see small debts being paid off.

- Make consistent and timely debt payments to avoid late fees and maintain a good credit score.

- Consider debt consolidation options, such as transferring high-interest credit card balances to a lower-interest personal loan.

By prioritizing and paying off debt, you can reduce financial stress and work towards a more secure financial future.

Avoiding Common Debt Traps

Avoiding common debt traps is crucial for managing your finances wisely and avoiding unnecessary debt. Here are some common debt traps to watch out for:

- Credit card debt: Avoid using credit cards to finance discretionary expenses unless you can pay off the balance in full each month. High-interest credit card debt can quickly accumulate and become unmanageable.

- Car payments: Avoid taking on a car payment that exceeds your budget. Consider buying a used car or leasing to lower your monthly payment.

- Payday loans: Avoid payday loans, which often have extremely high interest rates and can trap you in a cycle of debt.

- Overspending on housing: Avoid taking on a mortgage or rent payment that exceeds a reasonable percentage of your income. High housing costs can strain your budget and leave little room for savings.

By being mindful of these common debt traps, you can make informed financial decisions and avoid unnecessary debt.

Budgeting with a low income requires smart planning and discipline. By understanding your expenses, setting realistic goals, and crafting a flexible budget, you can take control of your finances. Cutting down on unnecessary expenses, exploring additional income streams, and implementing effective savings techniques are key strategies. Managing debt wisely is crucial to financial stability. Remember, every small step towards financial empowerment counts. With dedication and perseverance, you can achieve your financial goals and build a secure future. Start your journey to financial freedom today!